Liquid Trading Hedge Fund

A long/short trading fund with exposure in liquid cryptocurrencies

Active exposure to Liquid Crypto Assets

A long and short hedge fund which seeks to outperform the top 20 crypto index through position trading, hedging and the use of derivatives.

Cum. Performance of 1260%

Performance gross of fees since inception of the fund in 2019

Ex-US only

The fund accepts accredited investors from outside of the USA

Monthly Subscriptions

Subscriptions and redemptions open on a monthly basis

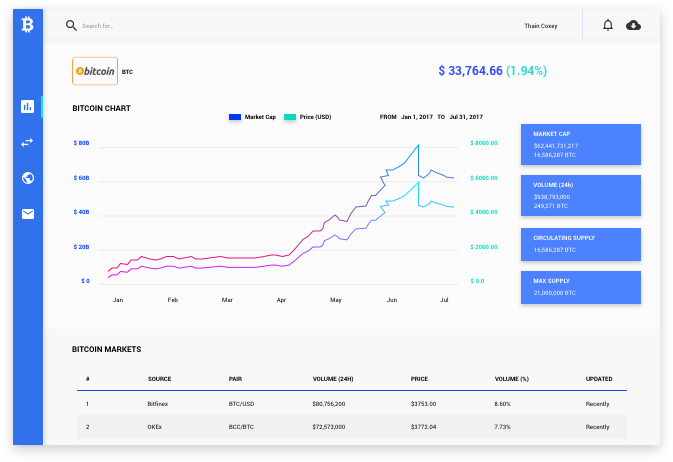

Overview

The goal of the fund is to gain exposure to growth assets within the crypto ecosystem by the use of discretionary momentum trading. The fund generally takes exposure to liquid markets within the top 20 traded volume and seeks to hold such assets for a period of 1 - 12 months.

The fund utilizes derivatives such as futures and perpetual swaps for the purpose of hedging exposure during times of turbulence and volatility. At times, options contracts may be used either for value speculation or countertrend hedging.

As the mandate is centered around liquidity of the portfolio, the fund does not take any significant exposure to primary market investment opportunities.

Performance Metrics

Cumulative Returns: 1265.0%

Volatility Annualized: 105.6%

Sortino Ratio: 5.15

Returns Annualized: 219.5%

Sharpe Ratio: 2.07

Max Drawdown: -36.8%

Mandate

The mandate and investment thesis of the fund is technically driven, however fundamentally allocated. Utilizing a thematic approach to crypto markets, the assets held by the fund may change or be diversifies amongst one or several core areas including, but not limited to; protocols, NFTs, DeFi assets, currency and staking.

For the purpose of capital preservation and a hedge against the large volatility that the market can at times present, the fund has the ability to use derivatives on a discretionary basis to deal in options or futures. The aim of the fund is the experience significantly less volatility than the crypto index as a whole which still achieving outperformance in alpha.

Offer Snapshot

Tenure: Open-ended

Inception: Jan 2019

Minimum investment: $100,000

Management Fee: 2%

High Watermark: Yes

Lockup: 12 months

Domicile: Cayman Islands

Denomination: USD

Mandate: Multi Strat

Performance Fee: 20%

Hurdle Rate: 5%

Redemptions: Quarterly

Operational

Custody: Third-Party

Reporting of NAV: Monthly

Fund Reporting: Monthly

Banking: Signature (NY)

Performance History

The below includes unaudited performance which is updated on a monthly basis.

Request Fund Documentation

Should you wish to express interest in subscribing to this fund, please complete the below form and one of our team members will send you the relevant information pack.

Stack Funds

Copyright © 2021 Stack Funds. All rights reserved.