Crypto Arbitrage Fund

A market neutral fund exploiting price differentials in cryptocurrencies

Market Neutral Returns in Cryptocurrency

A multi-strat fund which exploits intertemporal and geographic price differentials in the most established cryptocurrencies to generate returns regardless of the directional movement of the market itself.

112% return since inception

Performance gross of fees for the fund since the inception date

Open to Investors Globally

The fund accepts accredited investors from the USA as well as offshore

Monthly Subscriptions

Subscriptions and redemptions open on a monthly basis

Overview

The Arbitrage Fund is a SciTech cryptocurrency hedge fund specialized in systematic arbitrage. The firm was conceived by a diverse group of partners with extensive backgrounds in equity trading, quantitative research, technical development, and information technology. They had foresight about the growing universe of crypto assets and building wealth while managing risk for the sophisticated investor.

We bring together decades of proven strategies in emerging market dynamics, backed by expertise in quantitative analysis, risk management, and security. Our team takes pride in constantly improving our proprietary high-frequency trading algorithms, enabling investment strategies that have produced consistent returns for our clients since the start of our operations.

Performance Metrics

Cumulative Returns: 112.1%

Volatility Annualized: 7.6%

Sortino Ratio: 14.02

Returns Annualized: 23.3%

Sharpe Ratio: 2.97

Max Drawdown: -0.2%

Mandate

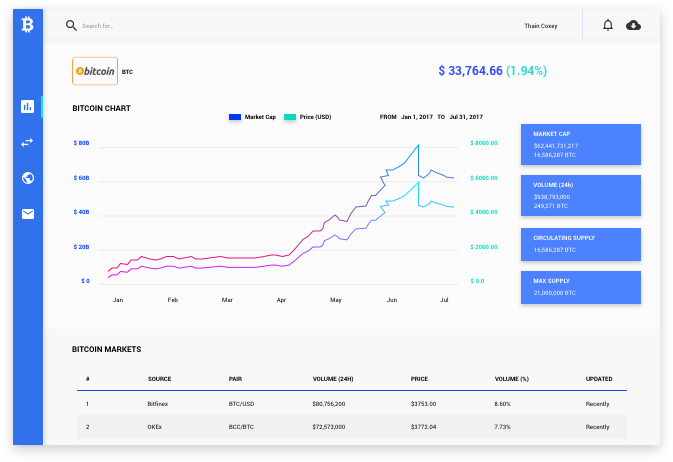

The Fund exploits intertemporal and geographic price differentials in the most established cryptocurrencies to generate returns regardless of the directional movement of the market itself. The team has taken the basic trading principles of equity arbitrage learned over years of experience and adapted them to the emerging cryptocurrency universe.

The Fund engages in market neutral and Delta One strategies with no residual exposure. The strategies include trading spot listings across exchanges in order to benefit from price discrepancies, as well as monetizing price differentials by trading spot against futures and swaps. Most trading execution is done through secure automated systems, driven by bespoke proprietary algorithmic programs.

Offer Snapshot

Tenure: Open-ended

Inception: Jan 2018

Minimum investment: $100,000

Management Fee: 2%

High Watermark: Yes

Lockup: 1 month

Domicile: Bahamas

Denomination: USD

Mandate: Multi Strat with a focus on arbitrage

Performance Fee: 20%

Hurdle Rate: -

Redemptions: Monthly

Operational

Custody: Third-Party

Reporting of NAV: Monthly

Fund Reporting: Monthly

Banking: Signature (NY), Silvergate

Performance History

The below includes unaudited performance which is updated on a monthly basis.

Request Fund Documentation

Should you wish to express interest in subscribing to this fund, please complete the below form and one of our team members will send you the relevant information pack.

Stack Funds

Copyright © 2021 Stack Funds. All rights reserved.